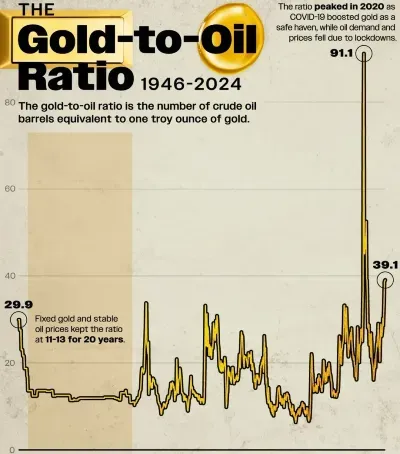

The Gold Oil Ratio

The Gold:Oil Ratio is a direct comparison of the price of one oz of gold in oil barrels. It is a great general reference point for sentiment in regards to growth vs capital preservation. The ratio has generally stayed between the range of 10 and 35. Over the past