Gold Flows

The flow of capital from paper assets to real assets, from debtors to savers, from soft money to hard money, from the occident (land of the setting sun) to the orient (land of the rising sun)—from West to East.

Today is a big-picture day. The goal is to describe the largest underlying trend, and to stitch together a few ideas from Another, FOA/FOFOA, and Antal Fekete, along with some previous posts. To start, here are a few pieces from Another:

“We must view the world in a broad context, just as much as in a detail perspective. The larger perception can be just like looking at a river in the valley from the ridge above. From far away it's easy to see what direction national trends are flowing. The whole body moves as one, always towards the sea. The problem comes when we get too close and interpret things using only a small river section in front of us. More often than not, the white water we see only hides a deeper flowing truth.”

— Another

“For us to see the whole board we must wade away from shore. Away from all the shallow water traders and into the deep blue. There we can feel the real current.

Our dollar has had a usage period that corresponds with the society that interacts with it. Yes, just like people, currencies travel through seasons of life. Even gold currencies, in both metal and paper form, have their ‘time of use’. Search the history books and we find that all ‘OFFICIAL’ moneys have at one time come and gone with the human society that created them. Fortunately, raw gold has the ability to be melted so it may flow into the next nation’s accounts as ‘their new money’.

This ebb and flow of all currencies can be described as their ‘timeline’. We could argue and debate the finer points, but it seems that all currencies age mostly from their debt build-up. In a very simple way of seeing it, once a currency must be forcefully manipulated to maintain its value, it is entering the winter of its years. At this stage the quality of manipulation and debt service become the foremost determinant of how markets value said money. Suddenly, the entire society values their currency wealth on the strength and power of the state’s ability to control, not on the actual value of the money itself. Even today our dollar moves more on Mr. Greenspan’s [or Bernanke today] directions than from the horrendous value dilution it is receiving in the hands of the US treasury.”

— Another

“Now look back to shore and watch the world traders kick ankle deep water in each other’s faces over the daily movements of Euros. From here, up to our necks in blue water, you ask ‘What the hell are they doing?’ I’ll tell you. They are trying to make $.50 on a million dollar play! Mostly because they are seeing the chess game one move at a time. (smile) Truly, their real wealth is in long term jeopardy.”

— Another

“You see, it all has to do with how one orients oneself in the world today. Indeed, understanding the word ‘orient’ provides some of the answers. Interesting word, orient.

The old Romans didn’t have compasses and they depended on the position of the sun to gain location and direction each day. Every morning they would watch to see where it rose. They gave the name ‘oriens’ to this location. In other words, the east. Later, ‘oriens’, obviously a Latin derivative, was slipped into English and it became orient. Not only was orient used to describe one’s positioning in the world, it also referred to all the lands east of Europe. The Asians, etc.

In time, most of the world’s thought could be broadly divided into Western and Eastern. How well one understood such thought and the people forces that created them, depended very much on how well we could orient our own thinking! Are you still with me? (smile)

For myself, I have placed my feet squarely on the ground that faces East to gain a better understanding. Because from here not only do the majority of the world’s people live, there also resides most of the reserves of oil. Remember, ‘oriens’ became ‘orient’ and that traditionally was all the lands east of Europe. The Middle Eastern oil fields included!

Now, over time and across the space of human experience, Europe has become much better ‘orientated’ to the ‘orient’ way of trading and thinking than the West. To this end they will always meld better with them economically than the US can.”

— Another

What he’s getting at with orientated is the reference point for value. Do you use depreciating dollars as a reference? Or do you use what the Orient historically used—gold?

In much of Eastern thinking, gold is still regarded as real wealth and dollars as paper. In the West, people have become accustomed to paper money and consider it normal—so normal that using anything else is treated as unthinkable, or even crazy.

History doesn’t progress in a straight line. It moves in cycles—cycles where civilizations shift their orientation from hard money to soft money and back again. So it matters where we are in the cycle if you want to orient yourself properly. Which way will you orient?

Antal Fekete sees a transfer of wealth where capital flows from West to East again. When Rome fell, the western part of the Roman Empire entered the Dark Ages while the East (Byzantium) continued using gold coinage and thrived for centuries.

What often gets missed in that story is the currency debasement and inflationary collapse. Consider this excerpt about the hyperinflation during Diocletian’s reign:

“Over the period 218 to 268 A.D. the silver content of Roman coins dropped to one five thousandth of its original level.... Diocletian tried to bring back some honesty to the coinage by issuing copper coins that were not purporting to be something they were not.... But Diocletian had issued vast amounts of copper coins. This led to price increases. When prices rose Diocletian attributed the inflation to the greed of merchants. In 301 AD Diocletian issued an edict declaring fixed prices; i.e., price controls. His edict provided for the death penalty for anyone selling above the control prices. There was also penalties (less severe) for anyone paying more than the control price. Irate consumers sometimes destroyed the businesses of those who sold higher than the control prices. In the short-run these draconian measures may have curbed inflation but in the long-run the results were disaster. Merchants stopped selling goods but this led to penalties against hoarding.”

It’s hard not to see echoes of this pattern in modern systems: debasement, distortions, controls, scarcity, and social stress.

Wikipedia summarizes the downstream effects:

“According to Rostovtzeff and Mises, artificially low prices led to the scarcity of foodstuffs, particularly in cities, whose inhabitants depended on trade to obtain them. Despite laws passed to prevent migration from the cities to the countryside, urban areas gradually became depopulated and many Roman citizens abandoned their specialized trades to practice subsistence agriculture. This, coupled with increasingly oppressive and arbitrary taxation, led to a severe net decrease in trade, technical innovation, and the overall wealth of the empire.”

— Wikipedia

Decentralization, at last—though not the pleasant kind. Those who weren’t prepared suffered. And as conditions deteriorated, gold went into hiding.

FOFOA frames the broader mechanism this way:

“Today we are living the end of the longest stretch of time in which ‘the easy money camp’ has been in power both politically and monetarily. For a century now they have been easing our money more and more. And for those of you obsessed with the ‘emerging’ NWO and One-World Currency... surprise! You’ve been living with it for 66 years now [since 1944 – Bretton Woods Conference].

This latest push for central control and massive deficit spending by the ‘easy money camp’ is simply the blow-off phase right before the long awaited collapse. And when easy money collapses, the transition is always financially painful but not necessarily bloody like the French Revolution, which was the end of the ‘hard money camp’.

Now, what happens during ALL periods in history… is a transfer of wealth. This is important! Because when the easy money guys are in power the transfer of wealth happens slowly and gradually, and wealth flows from the Savers to the Debtors. But when ‘easy money’ collapses—and it ALWAYS collapses—there is a very RAPID transfer of wealth in the other direction, from the Debtors back to the Savers.

…There are many many people who consider themselves Savers who are still sitting in the wrong camp, and will be on the WRONG side of the coming—extremely rapid—transfer of wealth.

…Don’t take financial advice from me! For that matter, don’t take financial advice from ANYONE. Think it through yourself, quietly. Use your own head. This is the only path to peace of mind.

It is easy to watch the dollar losing its reserve privilege today. And it is also easy to see who will come out ahead when it happens. All else is noise. Choose your camp wisely.”

— FOFOA

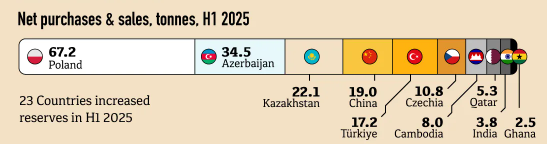

Here is the Central Bank gold purchase data from H1 2025, clearly showing the most recent accumulators. Credit to BuillionVault and the Visual Capitalist for the image.

And, finally:

“Follow in the footsteps of giants, and carry your future in both hands, carry gold.”

— Another

References:

http://fofoa.blogspot.com/2010/07/debtors-and-savers.html

https://www.visualcapitalist.com/sp/charted-a-decade-of-central-bank-gold-purchases/