What is Freegold?

FOFOA is a long-form, pseudonymous blog focused on gold, money, and the failure modes of modern fiat currency systems, written primarily between roughly 2008–2014. It is not a news site or investment blog in the conventional sense. It’s a theoretical framework for understanding what happens to money when confidence collapses.

At its core, FOFOA explores one central idea:

Gold is not an investment, a commodity, or a hedge — it is a final settlement asset that reasserts itself when currency systems fail.

Everything else on the blog flows from that premise.

FOFOA Summarized - by myself and the help of LLM

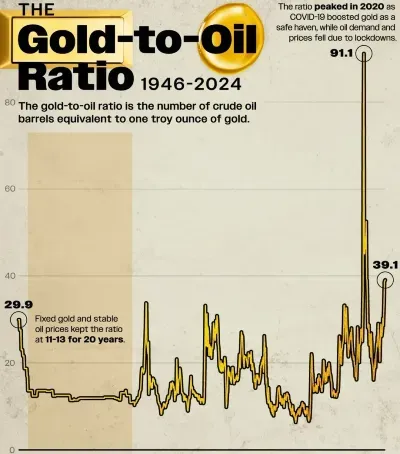

1. Gold vs Currency

FOFOA argues that most people misunderstand gold because they view it priced in dollars.

Instead, he flips the perspective:

- Currencies are measured through gold

- Gold does not move within currency systems — currencies move around it

When currencies fail, gold doesn’t “rise”; the currency falls away from it.

2. Freegold

FOFOA popularized and expanded on the concept known as Freegold:

- Gold trades freely at a floating price

- Gold is removed from daily commerce

- Currencies handle transactions

- Gold handles wealth storage and settlement

This is not a gold standard. It’s a bifurcated system, paper for spending, gold for saving and final settlement.

3. The Endgame of Fiat Systems

FOFOA’s work is largely about how fiat systems end, not if they end.

Key points:

- Fiat systems survive on confidence, not solvency

- Central banks suppress gold because it reveals loss of confidence

- Suppression works only while a reserve currency exists

- When reserve status breaks, gold reprices violently and permanently

This repricing is not a “bubble” or “mania” — it’s resetting the unit of account.

4. Physical vs Paper Gold

FOFOA draws a sharp distinction between:

- paper gold - futures, ETFs, certificates

- physical gold - allocated, deliverable metal

Paper gold exists to delay repricing. Physical gold is what matters when settlement is demanded. This is why delivery, backwardation, and bullion flows are central topics.

5. Central Banks Know This

A recurring argument:

Central banks understand gold better than markets do.

Evidence FOFOA points to:

- Central banks accumulating gold quietly

- Leasing instead of selling

- Marking gold to market, especially in Europe

- Treating gold as a balance-sheet backstop, not a commodity

In FOFOA’s view, gold is already money at the highest level, just not acknowledged publicly.

6. You Are a Spectator, Not a Player

One of FOFOA’s most distinctive perspectives:

- The “currency war” is fought by nation-states and central banks “the Giants”

- Individuals cannot influence the outcome

- Individuals can choose how to position themselves

Owning gold is not activism or rebellion. It’s non-participation in a failing measurement system.

Why It Resonates With Your Relaunch

FOFOA aligns closely with the themes you’ve been curating:

- cycles over narratives

- structure over price

- credibility over policy

- settlement over speculation

- physical reality over financial abstraction

In short:

FOFOA is about what money becomes when trust disappears — and why gold is what remains.